Bad credit home equity loans texas

You dont need to be a first-time homebuyer to take advantage of the Homes Sweet Texas Home Loan program which offers 30-year fixed-rate mortgages and down. Consider a home equity loan.

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Consolidate your debt using home equity.

. All other requirements are what you would typically find with other providers of signature loans for bad credit. Theres no minimum credit scoreNo other mortgage offers this benefit but these loans are only open. Home equity loans home equity lines of credit HELOC or cash-out refinance loans.

Established in 1868 and with 130 branches spread across Texas Frost is a full-service bank that offers checking and saving accounts personal loans insurance investment products and. In particular FHA loans are available to borrowers with credit scores as low as 580. Bethpage offers the unique option to convert some or all of a variable-rate HELOC to a fixed-rate.

Applying for a personal loan with Bad Credit Loans takes no more than five minutes of. See all best mortgage lenders by state. One popular strategy for people who need to borrow money but who have poor credit is to turn to a secured loan.

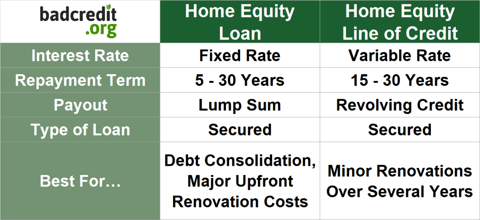

Short-Term Bad Credit Loans. You need to be over 18 provide proof of citizenship have a checking account and hand over your contact details. Loan amounts for home equity loans and HELOCs range from 5000 to 200000.

However many lenders have their own minimum credit requirements of 620 or more which makes it difficult for some veterans to qualify for a VA loan. Its aimed at borrowers without any credit history or who dont meet. Consolidate your debt using home equity.

The credit union offers home equity loans and HELOCs in 46 states excluding Alaska Hawaii Maryland and Texas. Title loans first emerged in the early 1990s and opened a new market to individuals with poor credit and have grown increasingly popular according to studies by the Center for Responsible Lending and Consumer Federation of America. To learn more schedule a.

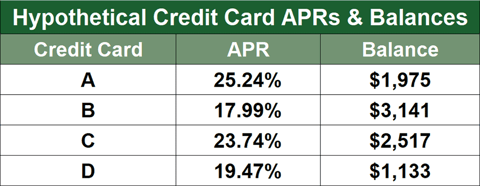

These loans do not meet conventional guidelines because the borrower has bad credit a recent bankruptcy or cannot fully document income. Credit Cards for Bad Credit Student Credit Cards 0 APR Credit Cards No Foreign Transaction Fee Credit Cards Business Credit Cards Chase Sapphire Preferred Capital One Venture Citi Double Cash Capital One Quicksilver American Express Blue Cash. How did you hear about Equity Smart Home Loans.

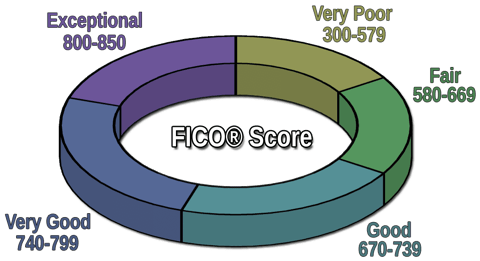

Borrowers with imperfect credit may qualify for a bad credit mortgage loan with alternative homebuyer programs. Credit Score chart by NerdWallet First Name. Home equity loans with bad credit.

There are more than 5000 branch locations in the US in addition to its. These loans also carry minimal closing costs in comparison to typical mortgage loans. CDs Savings Checking Prepaid Cards.

Home equity loans with bad credit. Why LendingPoint is the best for small loans. If you are in the middle of a home remodel and youre thinking of a tiny home or even a pole barn structure Acorn Finance can get you the financing you need.

These loans generally come with fixed rates and repayment periods between five and 30 years. Facebook Instagram Youtube Linkedin Tiktok. But you will have to come up with a 35 down payment.

Veterans with bad credit should look into getting a VA loan. No matter your credit score if you want to secure tiny home financing in California Texas Colorado or anywhere across the US Acorn Finance will. Some lenders with tighter credit requirements have a 5000 minimum for personal loans but LendingPoint lets bad credit borrowers take out as little.

A secured loan such as a home equity loan is any loan that has some form of collateral securing the debtFor example when you get a mortgage to buy a home the home serves as collateral for the debt. VA Loan Requirements with Bad Credit. Check out alternative loans.

Ask a Home Equity expert about obtaining a 1st or 2nd lien a Home Equity Line of Credit HELOC or a Home Improvement Loan to best fit your needs. CreditNinja operates as a Credit Access Business 159810. The financial institution which serves 25 million members was established in 1935 and.

Get tiny home financing today without impacting your credit score. Elevate your Bankrate experience Get insider access to our best financial tools and content Get started. VA loans are also available for credit scores as low as 500.

Portfolio loans are non-conventional loans that do not meet Fannie Mae or Freddie Mac guidelines. Plus refinancing loans and home equity lines of credit. A portfolio loan is a mortgage that a lender holds onto in their investment portfolio after closing.

VA Loan Credit Score Requirements. The Future Income-Based Loan is one of two student loans Ascent offers to undergraduates that dont require a co-signer. The requirements for VA loans are more flexible than any other loan program available.

Why Bethpage Federal Credit Union is the best home equity line of credit with a fixed-rate option. Headquarters 1499 Huntington Dr Suite 500 South Pasadena CA 91030 United States Call us now. Homes Sweet Texas Home Loan Program.

Bad credit student loans come with higher interest rates but there may be options to lower those rates such as by adding a co-signer. Bank of America is a big bank lender that offers mortgage and refinance loan products along with full banking services. A home equity loan is more closely related to a HELOC than a home equity investment.

VA loans have the most generous credit score requirements. Texas NMLS856170 See More. Co-signers can be used for many different types of products including auto loans student loans home equity loans and home equity line of credit products.

Application and Funding Time. CreditNinja is licensed by the Delaware State Bank. A home equity investment on the other hand is much different.

A big hit like this will affect your ability to qualify for personal loans. These loans all require that you have sufficient equity in your home generally between 15 and 20 and your approval will depend on your credit report combined loan-to-value ratio debt-to-income ratio. Car Loans Home Equity Loans Mortgages Personal Loans.

There are several ways to tap into your homes equity. They are the cousin of unsecured loans such as payday loansSince borrowers use their car titles to secure the loans theres risk. A home equity loan lets you access an amount of cash based on your homes value.

Borrowers make fixed monthly payments for the duration of the repayment period to pay off the loan.

Receiving A Home Equity Loan With Bad Credit Compass Mortgage

Getting A Home Equity Loan In Texas How It Works Easyknock

How To Get A Bad Credit Home Loan Lendingtree

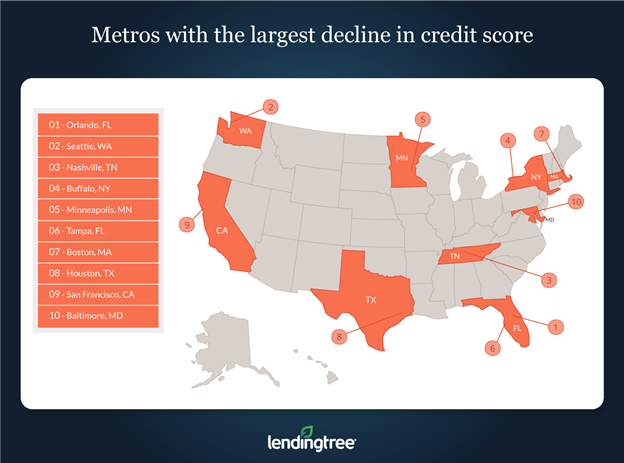

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

4 Subprime Home Equity Loans 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

9 Best Home Equity Loans Of 2022 Money

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Get A Home Equity Loan With Bad Credit Lendingtree

Home Equity Loans Pros And Cons Minimums And How To Qualify

Can You Use Home Equity To Invest Lendingtree

Home Equity Loans How They Work And How To Get One Smartasset

6 Types Of Home Equity Loans And Their Features Also Known As